Agile Real-Time Enterprise Payments Applications

Transacumen’s software helps financial institutions handle real-time payments more competitively, entering the market faster and at a lower cost.

why transacumen?

Financial institutions that process real-time retail or corporate payments need to look beyond standard and expensive products to improve competitiveness.

Transacumen’s open enterprise payments processing and quality assurance software enables payments processors to reach their market faster and with reduced cost.

Key Benefits for customers

-

Improve Service Delivery and Reduce Costs

Transacumen's open transaction platform can be used to implement any real-time payment type. Transaction logic can be customised for inbound and outbound payments, ensuring efficient integration with internal systems and external parties alike.

-

Deploy in the Cloud or On-Premise

Transacumen's open transaction platform has been engineered to support deployment to the cloud or to on-premise infrastructure. Systems can be created on-demand, leading to reduced infrastructure costs and improved organisational agility.

-

Outcompete in the Digital Economy

Enabled with Transacumen's enterprise payments processing and quality assurance software, payments processors will see increased digitisation, new payment models and industry disruption as an opportunity to grow market share.

-

Improve Service Delivery and Reduce Costs

Transacumen's open transaction platform can be used to implement any real-time payment type. Transaction logic can be customised for inbound and outbound payments, ensuring efficient integration with internal systems and external parties alike.

-

Deploy in the Cloud or On-Premise

Transacumen's open transaction platform has been engineered to support deployment to the cloud or to on-premise infrastructure. Systems can be created on-demand, leading to reduced infrastructure costs and improved organisational agility.

-

Outcompete in the Digital Economy

Enabled with Transacumen's enterprise payments processing and quality assurance software, payments processors will see increased digitisation, new payment models and industry disruption as an opportunity to grow market share.

Improve Service Delivery

and Reduce Costs

Transacumen’s open transaction platform can be used to implement any real-time payment type. Transaction logic can be customised for inbound and outbound payments, ensuring efficient integration with internal systems and external parties alike.

Deploy in the Cloud or

On-Premise

Transacumen’s open transaction platform has been engineered to support deployment to the cloud or to on-premise infrastructure. Systems can be created on-demand, leading to reduced infrastructure costs and improved organisational agility.

Outcompete in the

Digital Economy

Enabled with Transacumen’s enterprise payments processing and quality assurance software, payments processors will see increased digitisation, new payment models and industry disruption as an opportunity to grow market share.

About Us

Agile and Real-Time Solutions

Founded in 2011, Transacumen provides agile, real-time payments software for progressive financial institutions and processors.

Innovative Architecture

Based on decades of experience, Transacumen has combined an innovative architecture with forward-thinking technology choices.

Empowering Processors

Our mission is to help payment processors seize opportunities and build market share by enhancing control over transaction initiation and servicing.

Efficient Implementation

Transacumen has created a transaction platform that can be implemented efficiently.

Scalable for Growth

Our platform scales to handle the growth of the largest institutions and can be deployed to the cloud or on-premise.

Financial institutions that regard payments as a utility are well attended to by large vendors and their inflexible, expensive products.

Craig Worrall, Founder

Transacumen assists organisations that see payments as core business, a differentiator or an opportunity for growth.

Stratum

STRATUM is an open, secure, scalable and reliable platform for implementing enterprise transaction switches, gateways and hubs.

Agility

Availability & Scalability

Security & Compliance

Cloud or On-Premise

Transaction Flexibility

Channel Library

Agility

STRATUM is a high-level and open platform that enables customers to address business requirements in-house. Applications can be implemented by configuring advanced components, and by developing custom channels and transaction types. Cutomisation is performed using non-proprietary tools.

Availability & Scalability

STRATUM applications are deployed across multiple servers, delivering the availability and scalability required by the most demanding payments processors. Applications run unmodified on lesser platforms, reducing costs during development, integration and support activities.

Security & Compliance

STRATUM allows a tailored security implementation for any payment type or application by supporting data tokenisation and data access-permission policies for individual fields in any message.

Cloud or On-Premise

STRATUM’s flexible architecture supports deployment of applications to Amazon Web Services, Microsoft Azure and Google Cloud.

Transaction Flexibility

STRATUM supports channel specific transaction processing for both upstream and downstream participants.

Channel Library

STRATUM applications integrate with other systems and devices by using or customizing existing channels, including ISO8583, AS2805, POS, HTTP and batch.

Immediate payments and new payment models are opportunities to outcompete and increase profits.

STRATUM and IAAS

STRATUM’s architecture and curated technology choices allows it to be deployed into Amazon Web Services, Microsoft Azure and Google Cloud. Deployment into a cloud-based environment delivers a range of advantages over traditional approaches to payments workloads.

-

Reduced Infrastructure Costs

Create STRATUM systems on-demand to avoid provisioning delays and costs. System lifecycle can be aligned directly with implementation and business-as-usual activities such as integration, performance testing, UAT and production support. When a distributed STRATUM instance is not explicitly required, such as for infrastructure failure tests, teams can deploy STRATUM applications unchanged onto single server platforms, reducing infrastructure costs by an order of magnitude.

-

Capacity On-Demand

STRATUM applications can scale dynamically as a result of transaction load changes and in accordance with pre-configured calendars. Dynamic scalability allows payments processors to avoid the time and cost of capacity planning exercises, the up-front costs of provisioning headroom and the business constraints of operating a fixed capacity platform.

-

Reduce Security Risk

Amazon Web Services, Microsoft Azure and Google Cloud all support policies, controls, procedures and technologies that work together to protect cloud-based systems, data, and infrastructure. These security measures have been utilised by cloud operators to comply with payment industry regulations such as PCI-DSS. By leveraging the associated certifications, customers that deploy STRATUM applications to the cloud are reducing both security risk and compliance cost.

-

Reduced Infrastructure Costs

Create STRATUM systems on-demand to avoid provisioning delays and costs. System lifecycle can be aligned directly with implementation and business-as-usual activities such as integration, performance testing, UAT and production support. When a distributed STRATUM instance is not explicitly required, such as for infrastructure failure tests, teams can deploy STRATUM applications unchanged onto single server platforms, reducing infrastructure costs by an order of magnitude.

-

Capacity On-Demand

STRATUM applications can scale dynamically as a result of transaction load changes and in accordance with pre-configured calendars. Dynamic scalability allows payments processors to avoid the time and cost of capacity planning exercises, the up-front costs of provisioning headroom and the business constraints of operating a fixed capacity platform.

-

Reduce Security Risk

Amazon Web Services, Microsoft Azure and Google Cloud all support policies, controls, procedures and technologies that work together to protect cloud-based systems, data, and infrastructure. These security measures have been utilised by cloud operators to comply with payment industry regulations such as PCI-DSS. By leveraging the associated certifications, customers that deploy STRATUM applications to the cloud are reducing both security risk and compliance cost.

STRATUM in the Cloud

Market Leading Agility

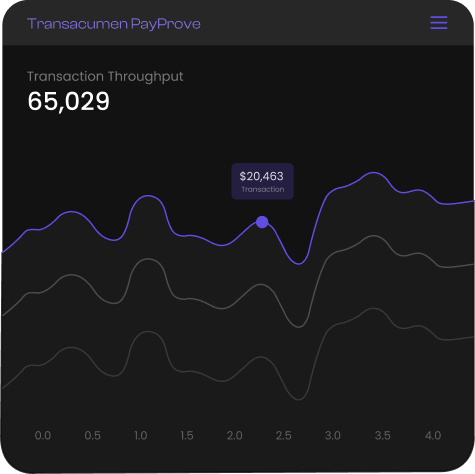

PayProve

PayProve is a quality-assurance product for the simulation, testing and certification of payments applications and devices.

Simulate Devices

Simulate Host Systems

Test Script Library

Utilise Common Tools

Dynamic Test Capacity

Non-Functional Tests

Simulate Devices

Simulate POS devices, Automated Teller Machines (ATM), and mobile device applications to test payments acquiring systems.

Simulate Host Systems

Validate the behaviour of gateways, POS, ATM, mobile devices, and other transaction sources by simulating payments acquiring systems.

Test Script Library

Utilise a comprehensive suite of test scripts and templates for rapid test development.

Utilize Common Tools

Use common tools, languages and modelling facilities to develop and modify test suites.

Dynamic Test Capacity

Resources can be dynamically allocated to meet varying quality assurance requirements.

Non-functional Tests

Contains a sophisticated set of failure, throughput, latency and capacity tests.

Exceed the demands of the digital economy.

Unconstrain your real-time payments capability with STRATUM and PayProve.

Get in Touch

If you would like to learn more about Transacumen’s payments software and platforms, please contact us.